LES Singapore – In-Person Seminar on Corporate Tax and Transfer Pricing Considerations in Intellectual Property Transactions

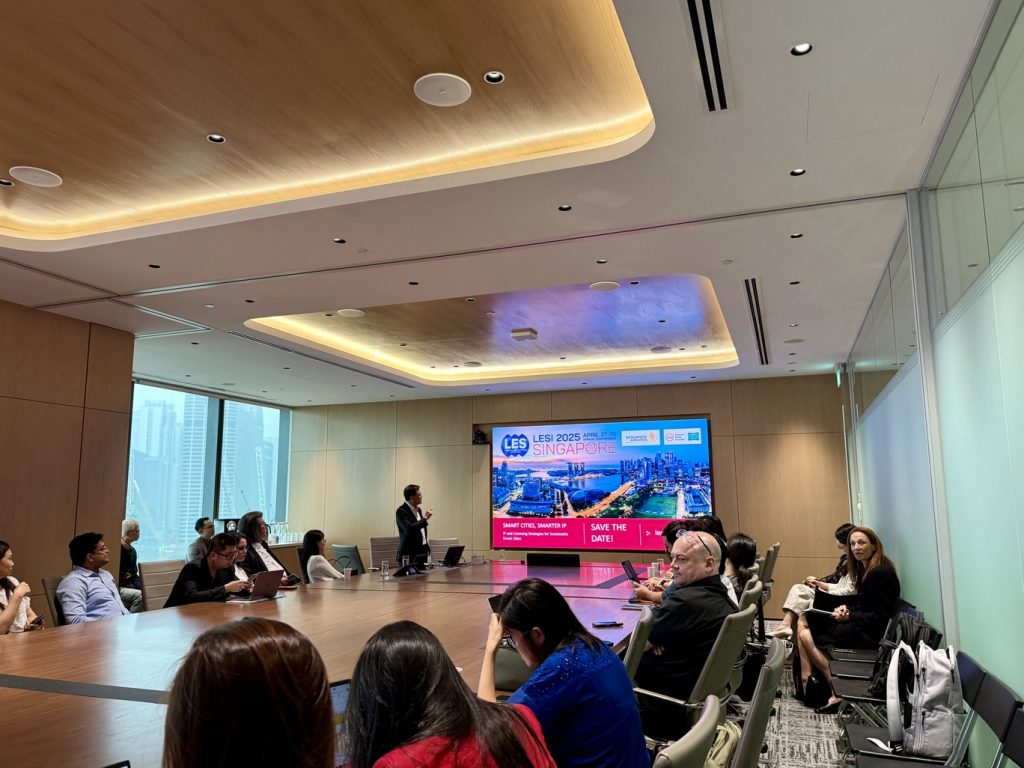

On Wednesday 15 January 2025, LES Singapore organised an in-person seminar on “Corporate Tax and Transfer Pricing Considerations in IP Transactions”. The seminar was specifically organised for non-tax professionals with the aim of bridging the gap of knowledge between IP professionals and tax related issues.

The seminar was presented by Mr Richard Goh, a Group Tax Specialist at the Inland Revenue Authority of Singapore, who has more than 10 years of experience in tax and transfer pricing valuation issues related to the acquisition and transfer of IP across various sectors.

Richard delivered an insightful presentation covering general tax considerations for common IP-related transactions and tax incentives across the IP lifecycle, including IP development, registration, licensing, acquisition, and commercialization. He also shed light on transfer pricing for intangibles, the gaps between IP and tax considerations, and the way forward for managing these complexities. He encouraged the IP professionals to keep abreast of tax related developments that may have an impact on IP transactions and also to provide feedback to IRAS when new tax regulations are announced.

The event concluded with an exciting networking session where attendees enjoyed food and drinks while exchanging thoughts and ideas on the seminar topics. The lively discussions underscored the relevance of tax and transfer pricing considerations in the ever-evolving landscape of IP transactions.